Changes to the Texas Homestead Exemption: New Five-Year Renewal Plan

Per https://www.hinshawcfs.com/

“Under the old law, taxpayers did not need to reapply for the homestead exemption in subsequent tax years, the exemption remained on the property until it was sold, the taxpayer moved and claimed it for a second property, or the taxpayer passed away. That has now changed.

New Law Requires Five-Year Renewal Plan

The Texas Legislature passed Senate Bill (SB) 1801, effective September 1, 2023, during the 88th regular session, which now requires the chief appraiser of an appraisal district to verify the eligibility of homeowners for the homestead exemption at least once every five years.

As a result, each of the 254 Texas Appraisal Districts must create its own procedure for complying with this periodic review program, and the first five-year review cycle has already begun. While each appraisal district started the first phase of the review process in January, it is possible many homeowners are unaware of this change or their need to reassert their qualification for a homestead exemption.

To comply, most Appraisal Districts mail taxpayers a notice instructing them to reapply for their exemption within the time stated in the letter. This can lead to confusion since taxpayers have never received a request like this before, and not all of the deadlines set by the different Appraisal Districts are consistent. Even more troubling, if the taxpayer does not respond, the Appraisal District moves forward with removing the homestead exemption.

For example, here are a few of the ways the Appraisal Districts are handling this process:

- The Travis County Central Appraisal District (TCAD) advised, in a January 3, 2024, press release, that “Starting in 2024, TCAD is required to verify a property owner’s eligibility to continue to receive their homestead exemption every five years. Property owners scheduled for re-verification will receive a notice from the District with instructions on how to complete the process.”

- The Williamson County Central Appraisal District (WCAD) posted a notice on their website that “You do not need to reapply unless: you moved to a new residence, you are applying for additional exemptions (over 65, Disabled Person, etc.), or WCAD has asked you to reapply due to periodic audits of our records”

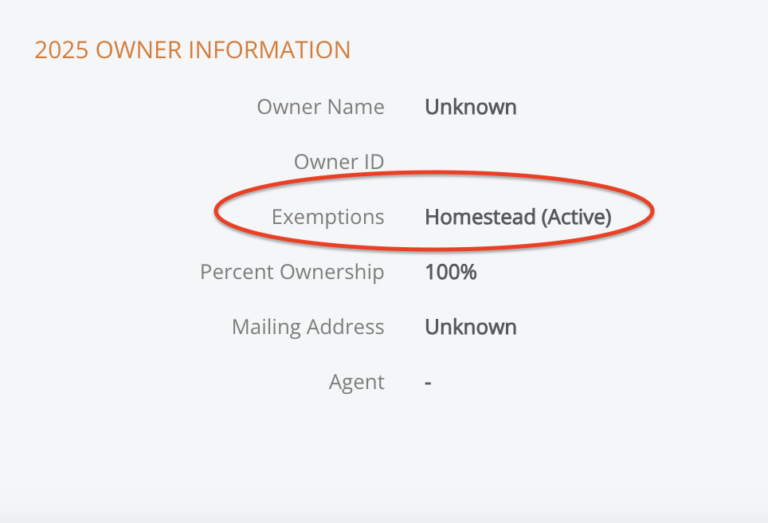

On Travis County’s site, the info is on the right side of the screen toward the top:

2) Set a recurring annual reminder to call the appraisal district to verify that you did not miss a deadline to reapply.

3) Make sure you open all of your mail, even if it looks like junk, that could come from your county.

4) NEVER pay to file a homestead exemption! If someone or something is asking for money to file it for you or to “help” you reapply, it’s a scam!

5) If you somehow missed the deadline to reapply for the exemption and they removed it, call the appraisal district immediately to get it put back in place. You can file an exemption retroactively up to 2 years, but you don’t want to wait to file/reapply!

No matter what…if you have any questions, please reach out to me! 512-468-9122 or rachel@rxrhometeam.com