Did You Know You Don't Have to Settle for the Lender's Interest Rate?

You Can Buy Down the Interest Rate!

You do NOT have to accept the interest rate your lender is giving you.

Most loans allow the seller to contribute up to a certain percentage toward your closing costs, which we refer to as seller concessions. With the lender’s approval, you can use those concessions to buy down the rate.

Here is an example from my preferred lender, Lynn Morenz, with Canopy Mortgage:

In the ORIGINAL OFFER column, you can see that a $365,000 home with a 6.625% interest rate, would have a monthly payment of about $1870 (principal & interest only, 20% down, 740 FICO score).

In the PRICE REDUCTION column, the monthly payment would be reduced only by $52 a month if the sales price were reduced by $10,000.

HOWEVER, if the seller were to contribute $10,389 toward the buyer’s closing costs to BUY DOWN the rate from 6.625% to 5.875% (that’s ¾ of a point), the monthly payment would be reduced by $143 a month!!

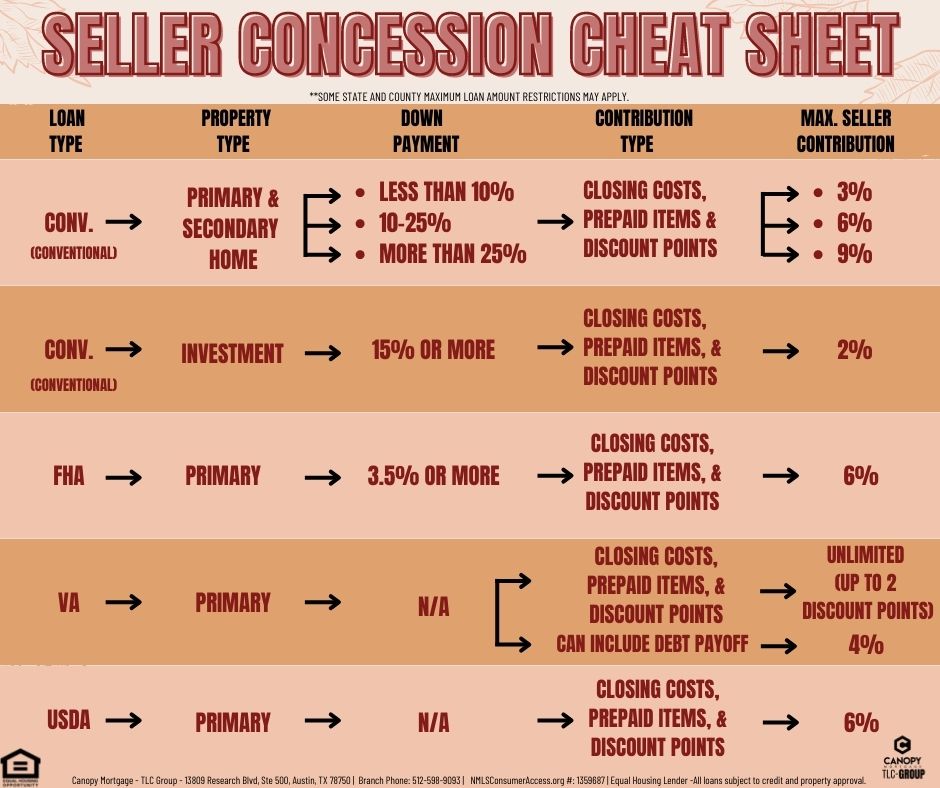

FHA loans allow sellers to contribute up to 6% of the sales price.

VA loans allow sellers to contribute up to 4% of the sales price.

Conventional loans allow varying percentages, depending on how much money you put down, but at least 3% is allowed with a 5% down payment.

“Marry the House, Date the Rate” – Market Update with Lynn Morenz from Canopy Mortgage

Refinancing Options for Investors – Market Update with Lynn Morenz from Canopy Mortgage

Are you interested in purchasing an investment property but don’t know if it’s a great time to buy? Knowing your options right now as well as down the road for refinancing can help you make the best decision! Canopy Mortgage‘s Lynn Morenz talks about options for investment properties and how a lender can help you along the way!